Using distributed ledger technology or similar technology

13 July 2023

A) Using distributed ledger technology (DLT)

To be classified as a crypto-asset, the electronic transfer and storage of a digital representation must use distributed ledger technology (DLT) or a similar technology. MiCA defined ‘distributed ledger technology’ in the same terms as those used in Regulation (EU) 2022/858 of 30 May 2022 on a pilot regime for market infrastructures based on distributed ledger technology (the ‘Pilot Regime’). These terms define DLT as widely as possible to capture all types of crypto-assets that currently fall outside the scope of EU legislative acts on financial services (Recital (16) MiCA).

As per the provisions of MiCA and of the Pilot Regime, a DLT is (a) a technology, (b) that enables the operation and use of distributed ledgers (Article 3-1(1) MiCA; Article 2(1) Pilot Regime). Distributed ledgers are information repositories that keep records of transactions and that are shared across, and synchronised between, a set of devices/processes that are part of a network (Article 3-1(2) MiCA; Article 2(2) Pilot Regime). Therefore, a DLT has a distributed nature (shared repository) as well as a partial decentralised nature (synchronised repository) where the “participants” in a network (‘nodes’) reach a consensus regarding the validity of new data entries by following a set of rules (World Bank Group, Distributed Ledger Technology, p. 6) - it is the so-called “consensus mechanism”.

MiCA also defines a “consensus mechanism” as the set of (a) rules and procedures (b) by which an agreement is reached, (c) for a transaction to be validated (d) among different devices/processes that are part of a network (i.e., the DLT network nodes) (Article 3-1(3) MiCA; Article 2(3) Pilot Regime).

Having regards to the above, a DLT is therefore a way of recording and sharing data across multiple data stores (also known as ledgers), which each have the exact same data records and are collectively maintained by a distributed network of computer servers/devices, called “network nodes” (PE, Cryptocurrencies and blockchain, p. 15).

However, the distributed and partially decentralised nature of a DLT does not say much about how many persons control it and how they control it. Indeed, “distribution” and “decentralisation” refer to different aspects of a DLT.

Distribution. The former concept (“distribution”) refers to the physical and architectural aspect of a system, specifically how/where data is stored and accessed. In a distributed system, data is stored across multiple physical locations, and the system operates as a cohesive unit. In the context of DLTs, distribution refers to the fact that the ledger (record of transactions) is spread across many nodes in the network. Each node has a copy of the entire ledger and updates of new transactions are propagated to all nodes (they are synchronised).

(De)Centralisation. The later concept (“decentralisation”) refers to the political and operational aspect of a system, specifically those who have control and authority over it. A decentralised system is one where control and decision-making are distributed among multiple parties. In the context of DLTs, decentralisation often means that no single entity has the power to control the record of transactions, and the consensus decision (e.g., the validation of transactions) is made by multiple participants. A centralised system, in the other hand, is one where a single party, like a central bank or a company, has ultimate control and decision-making authority.

The distributed nature of a DLT (“Distributed Ledger Technology”) does not imply, per se, that the ledger is equally decentralised. Therefore, the DLT may be partially (de)centralised (with a gatekeeper and an intermediary exercising control over the transactions) or fully decentralised (many players control the network and decide of the transactions validity independently, without intermediary).

Crypto-asset services provided in a fully decentralised manner (without a middleman authority), do not fall within MiCA’s application scope (Recital (22) MiCA). Furthermore, where crypto-assets have no identifiable issuer (i.e., typically crypto-assets of a decentralised system), they do not fall within many Titles of MiCA’s application scope (Recital (22) MiCA). Such is also the case of offers to the public where the crypto-assets are automatically created (without an identifiable issuer) as a reward for the maintenance of the DLT or the validation of transactions (Article 4-3 MiCA) - a validation process that, with regards to the Blockchain, is called “mining”. Nevertheless, CASPs providing services in respect of such crypto-assets are still covered by MiCA’s provisions (Recital (22) MiCA).

DLTs are a transformative technology (Recital (1) MiCA) that brought many advantages over traditional techniques, including transparency (DLTs record all transactions publicly, enhancing accountability and visibility), efficiency (DLTs can process transactions faster by eliminating intermediaries and administrative red tape), cost reduction (DLTs reduce operational costs by automating processes and eliminating the need for middlemen), security (DLTs use advanced cryptography for secure transactions, making them resistant to fraud and hacking), financial inclusion (DLTs can serve unbanked or underbanked populations by providing access to financial services without a traditional banking infrastructure) and tokenisation (DLTs enable the digital representation of assets’ value, making previously illiquid assets readily more accessible).

B) World’s first DLT: the Blockchain

The first and most well-known type/subset of DLT is the blockchain, particularly the Bitcoin Blockchain, followed by other subsequent alternative blockchains - e.g., the Ethereum Blockchain (Recital (1) MiCA; PE, Cryptocurrencies and blockchain, p. 15). The blockchain, which is only mentioned once in MiCA (Recital (1) MiCA), was first introduced in 2008 with a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" (Satoshi Nakamoto, Bitcoin). This paper was published online by an individual or group of individuals under the pseudonym Satoshi Nakamoto, of which very little is know except that it has a P2P foundation profile indicating it is a “male” from “Japan” (which may or may not be true) (Satoshi Nakamoto, P2P foundation).

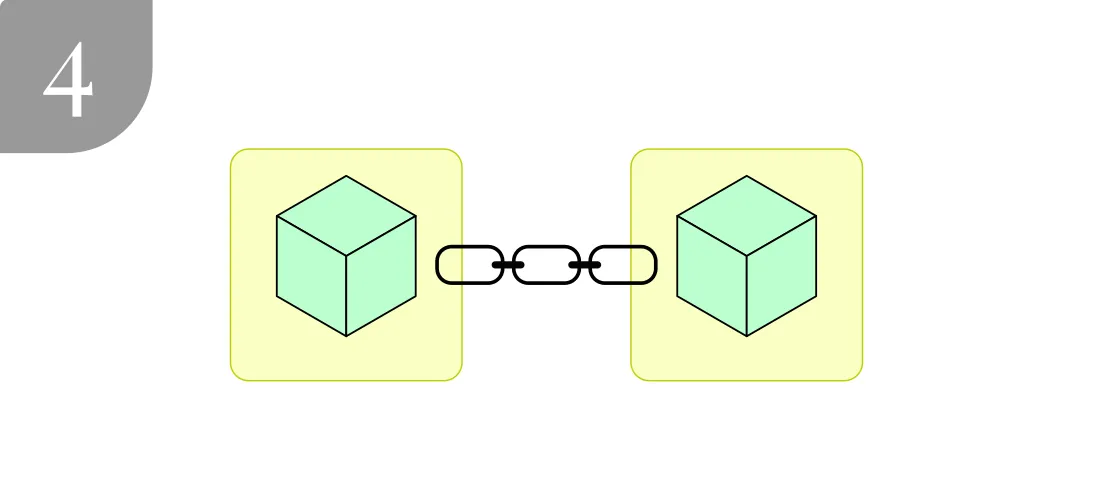

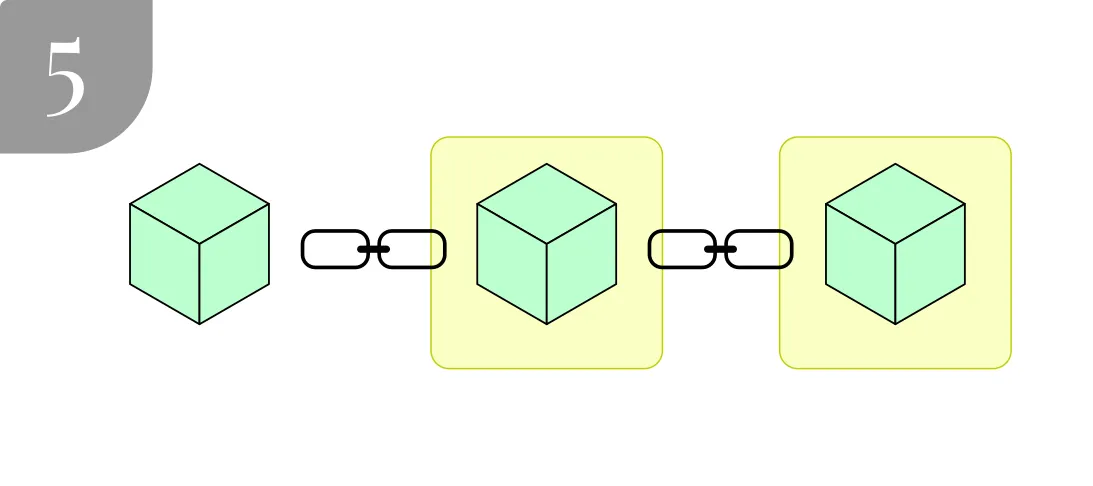

The blockchain is a DLT that employs an encryption method known as cryptography and uses specific mathematical algorithms to verify a continuously growing data structure taking the form of a chain of “transaction blocks” (PE, Cryptocurrencies and blockchain, p. 15). The servers/devices in the blockchain’s DLT network (i.e. the DLT network nodes) collectively verify and determine the block’s validity in accordance with algorithmic validation rules/procedures, commonly referred to as a “consensus mechanism”. Once validated, the new “block” is added to the blockchain (PE, Cryptocurrencies and blockchain, pp. 15 and 16). Consequently, the blockchain is a ledger with a distributed nature (which makes it a DLT within the meaning of MiCA) but also with a decentralised nature.

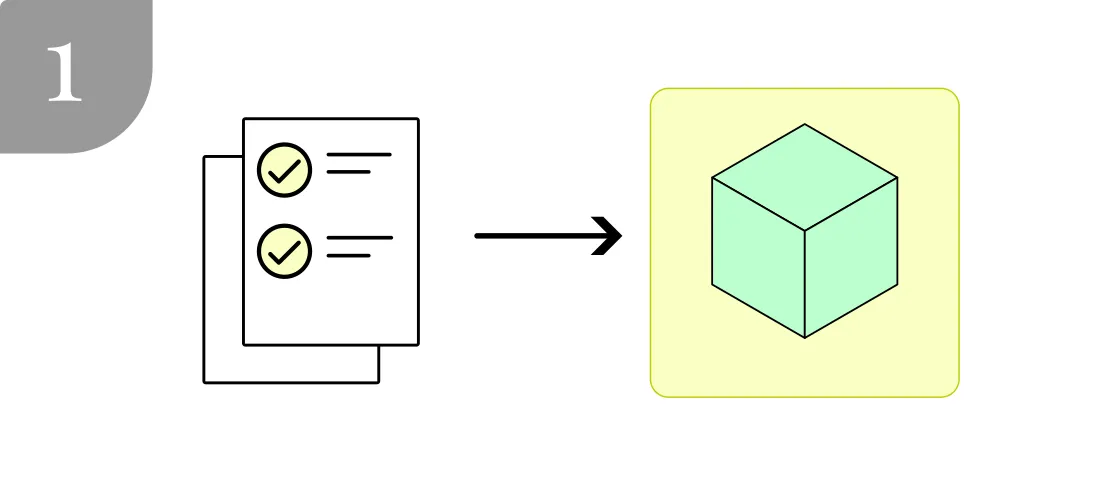

Data is recorded in a transaction block.

The transaction block representing now a value or a right is sent to every server/device in the blockchain’s network (i.e. the DLT network nodes).

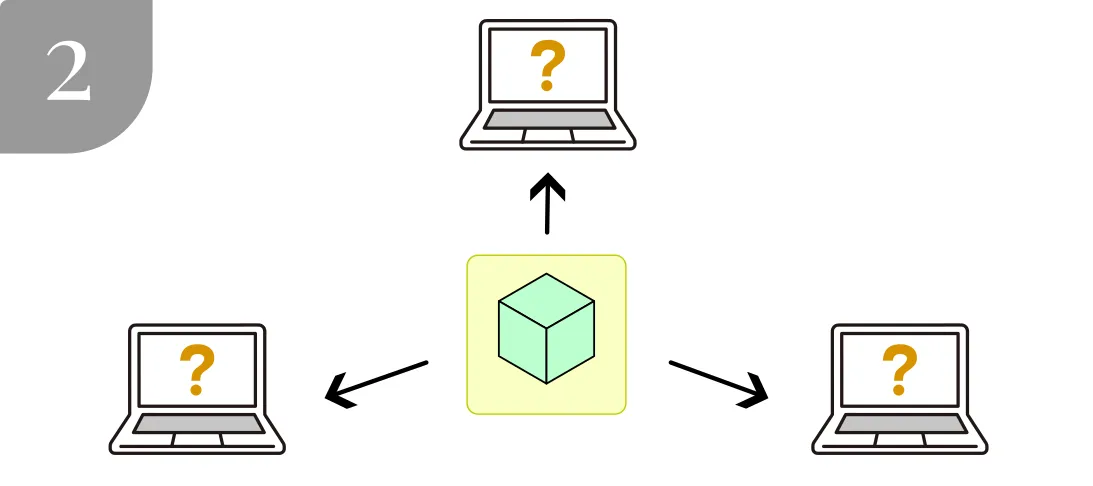

The DLT network nodes collectively verify and determine the block’s validity in accordance with the consensus mechanism (a set of algorithmic validation rules/procedures).

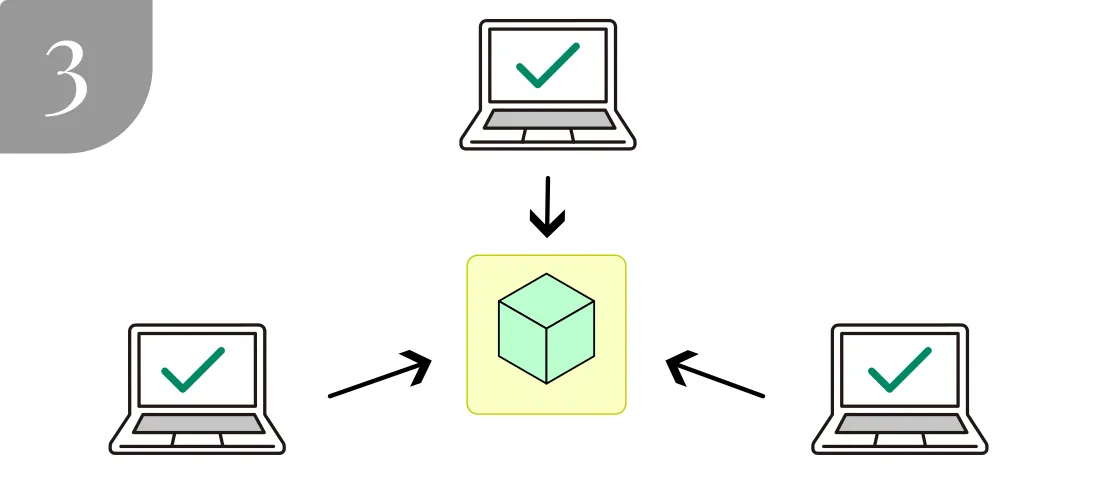

Once the transaction block is completed, the new “block” representing a value or a right is added to the existing chain of blocks within the distributed ledger/database.

A blank transaction block is generated and added to the existing chain of blocks, to allow the recording of new information within it.

The blockchain may probably be considered a fully decentralised DLT within the meaning of MiCA and, as such, crypto-assets offered/issued through it and (some) related services would appear excluded from MiCA’s application scope (see however above in Title A)). In any case, within 48 months after MiCA enters into force, the European Commission will present a report, accompanied by legislative proposals, with an assessment of the development of decentralised finance (DeFi) in the markets in crypto-assets and of the appropriate regulatory treatment of decentralised crypto-asset systems (Article 140-1 and 2(t) MiCA).

It is also worth remembering, that MiCA defines a “consensus mechanism” as a set of (1) rules and procedures (2) by which an agreement is reached, (3) for a transaction to be validated (4) among different devices/processes that are part of a network (i.e., the DLT network nodes) (Article 3-1(3) MiCA; Article 2(3) Pilot Regime).

A consensus mechanism can be programmed in various ways, i.e., with different rules and procedures. The two most well-known methods are the Proof of Work (“PoW”) mechanism and the Proof of Stake (“PoS”) mechanism (PE, Cryptocurrencies and blockchain, p. 18; (World Bank Group, Distributed Ledger Technology, p. 6).

Certain specific consensus mechanisms used for the validation of crypto-asset transactions may require energy-consuming server farms, that consume a similar amount of energy each year to individual countries like Spain, the Netherlands or Austria (BCE, Mining the environment). This suggests that the crypto-industry as a whole could have a significant carbon footprint (PE, Crypto-assets, p. 55; BCE, Mining the environment). This is particularly true for the Proof of Work (PoW) mechanism, which requires a vast amount of computing resources and consumes a significant amount of electricity (PE, Cryptocurrencies and blockchain, p. 18). As a result, MiCA refers in many instances the adverse impacts on the climate and other adverse impacts of some consensus mechanisms (Recital (7) MiCA; Recital (110) MiCA; Article 6-1(f) MiCA; Article 19-1(h) MiCA; Article 51-1(g) MiCA; Article 66-5 MiCA).

It is with this concern in mind that many DLTs, unlike the Bitcoin Blockchain, are increasingly shifting to 'proof of stake' mechanisms (CE, Impact Assessment, p. 65). For instance, the Ethereum blockchain switched the basis of its consensus mechanism, from Proof of Work to Proof of Stake (CE, Impact Assessment, p. 65; Ethereum, Proof of Stake).

However, it is important to note that consumption is not equivalent to carbon emissions, since the consumption may rely on the different energy sources used by the computers/devices to validate a transaction through the consensus mechanism (Carter, How Much Energy Does Bitcoin Actually Consume?; PE, Crypto-assets, p. 55).

Beyond blockchains, there are other types/subsets of DLTs that could be mentioned, such as Hedera Hashgraph or Tangle.

C) Using similar technologies to a DLT

Additionally, a crypto-asset may also be a digital representation that is transferred and stored by similar technologies to a DLT. In other words, will fall within the crypto-asset definition and be considered as a ‘crypto-asset’ not only digital representations that are transferred and stored in/by a DLT but also those transferred and stored by “similar technologies” to a DLT.

These terms appear to be an attempt to make MiCA future-proof (Recital (1) MiCA; Recital (16) MiCA), targeting potential new technologies that could emerge in the near future. It does not seem to refer to any existing technology and MiCA provides no example of such “similar technology”.

Even Hendera Hashgraph and Tangle, which are not Blockchains, are nonethless DLTs, since the term "DLT" is by itself very generic.

That being said, if the terms "similar technologies" are motivated by a concern to make MiCA future-proof, it is worth mentioning an interesting consideration from the Opinion of the European Central Bank of 16 February 2022 on the future AML Regulation ("AMLR1") (BCE, Opinion AMLR1). It states the following:

“The FATF Recommendations define a virtual asset as ‘a digital representation of value that can be digitally traded, or transferred, and can be used for payment or investment purposes. Virtual assets do not include digital representations of fiat currencies, securities and other financial assets that are already covered elsewhere in the FATF Recommendations’. AMLR1 takes over the definition of crypto-asset, which has been introduced in the proposed MiCA regulation and provides that “crypto-asset” means a digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology. The FATF definition is therefore technologically neutral, while the AMLR1 definition is limited to virtual assets based on distributed ledger technology or similar technology. It seems at least theoretically possible that virtual assets could also be based on another technology [than DLTs or similar technologies], in which case they would not seem to be covered by AMLR1 [and, incidently, not by MiCA]” (BCE, Opinion AMLR1, §6.2).

Incidently, the definition of "virtual assets" provided by the FATF guidances (FATF, Virtual assets guidance, §44; Current Article 1(20b) Luxembourg AML Law) may be technologically more neutral and, therefore, encompassing potentially more digital representations based on other technologies, than MiCA's definition of "crypto-assets" (Article 3-1(5) MiCA).